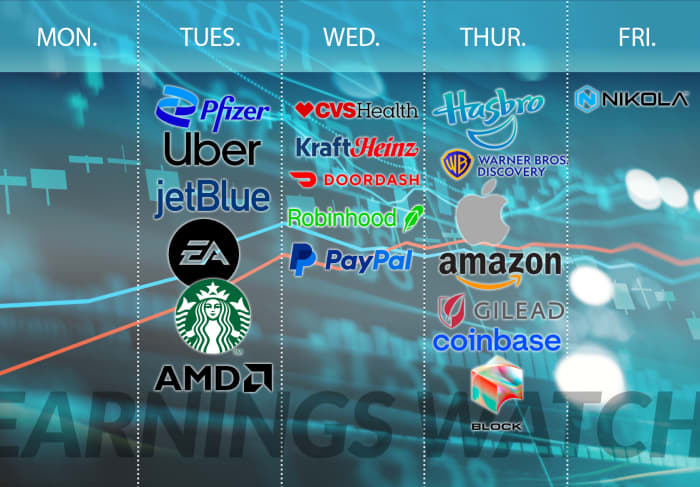

When Amazon.com Inc. and Apple Inc. report quarterly results on Thursday, we’ll get a look at two big companies, with big expectations, trying to do smaller things — or at least less exciting things, or things that might be more inconveniencing to customers — to stay bigger.

For Apple

AAPL,

The results from those companies, which are big enough to make or break a single quarter’s worth for the S&P 500 Index

SPX,

D.A. Davidson analyst Tom Forte, in a research note this month, said Amazon, like other big tech companies, was taking more steps to control its costs. That might help margins, he said. But he said he’d be watching for any impact to e-commerce sales growth, following thousands of layoffs and pulling back on its expansion of Amazon Fresh.

Amazon began tacking on servicing fees onto some Amazon Fresh delivery orders this year. And Forte noted what he said were other tweaks to service: Charging for a home pickup of a defective smoke alarm that used to be free, and incentives to wait longer during Prime Day.

“In our view, Amazon is playing a ‘game of chicken’ and banking on other e-commerce companies not to offer a superior service, instead of its historical approach of working backwards with a customer-obsessed approach,” D.A. Davidson analyst Tom Forte said in a research note.

He added later: “We believe there is something to be said about the experience of having an Amazon-branded delivery vehicle show up at your house EVERY day. Having one show up once a week or twice is not the same.”

At Apple, Forte said in a separate note, the iPhone, whose sales were still solid, had turned into more of a consumer staple than a discretionary buy. He also said he’d be looking for more detail about the upcoming iPhone 15 — likely to be modestly fancier than previous iPhones — the recovery in China and growth in India. Apple last month also unveiled its Vision Pro VR headset — for $3,499. Forte said he had his doubts.

“We believe Apple will have to overcome a number of structural challenges to achieve mass adoption for its AR/VR headset,” he said.

This week in earnings

Apple and Amazon will report as more companies than normal report quarterly profit ahead of estimates, according to a FactSet report on Friday. For the week ahead, 170 S&P 500 companies report results, with four from the Dow, the repot said.

Results from Uber Technologies Inc.

UBER,

With the “Barbie” movie lifting rival Mattel Inc.

MAT,

The call to put on your calendar

“Barbie,” the Hollywood strike and Warner Bros. Discovery: Mattel has said it wants to turn “Barbie” into a content franchise. Now we’ll hear what Warner Bros. Discovery Inc.

WBD,

The number to watch

Payments and crypto volumes: Results this week from trading app Robinhood Markets Inc.

HOOD,

UBS analysts predicted solid growth and cost control for Block, and “steady” e-commerce trends for PayPal. But BofA analysts said PayPal’s search for a new chief executive, following the announcement of Dan Schulman’s retirement at the end of the year, would become more important, adding that “we think investors should rightfully expect the CEO search to conclude in the near-term.” While Bitcoin’s rebound helped Coinbase, the company and others in the industry face the prospect of tougher regulations. Robinhood and PayPal report on Wednesday. Coinbase and Block report on Thursday.