What’s on our worry list? The labor market, specifically the unrest fomented by the effects of the pandemic and inflation. Labor unions have grown in might, their members are on strike, and employers are being forced to meet their demands. So we are adding a renewed wage-price spiral to our worry list, which could happen if a rebound in wage inflation leads to resurgent consumer price inflation.

Labor unrest in the United States has been on the rise in recent years. In 2022, there were 424 work stoppages — including 417 strikes and seven lockouts — up 52% from 279 in 2021.

Several factors have contributed to the rise in labor unrest:

1. Pandemic’s labor market effects: The U.S. economic recovery from the Covid-19 pandemic unleashed several shockwaves that impacted the labor market. As the economy reopened, workers pushed for higher wages and better benefits. Many did so by quitting their jobs for better paying ones. They could do so because the demand for labor exceeded the supply since May 2021. The former can be measured as the sum of the household employment (which counts the number of people with jobs) plus job openings, while the latter is simply the labor force. In May, for example, excess demand for labor totaled 3.7 million workers.

The U.S. unemployment rate was 3.6% during June. The short-term unemployment rate was just 2.9%, while the long-term rate was just 0.7%. The jobless rate for adults was 3.3%, and 11% for teenagers, which is a relatively low reading . Here are June’s unemployment rates by education level: college degree (2.0%); some college (3.1%); high school (3.9%), and less than high school (6.0%).

On the demand side of the labor market, job openings exceeded 10 million from June 2021 through January of this year, and have been hovering around 10 million through May. There were more than 1.5 job openings per unemployed worker from October 2021 through May 2023.

2. Pandemic’s inflation effects: The pandemic triggered a surge in inflation that started during 2021, peaked during the summer of 2022, and has moderated since. At first, inflation seemed to cause a wage-price spiral. While wages increased rapidly, so did prices. Inflation-adjusted wages stagnated from mid-2020 through early 2022. Many workers were frustrated to see that their pay increases were eroded by rapidly rising prices. That seems to be changing in recent months, as wages have been rising faster than prices. But many workers may not be experiencing that improvement in their purchasing power.

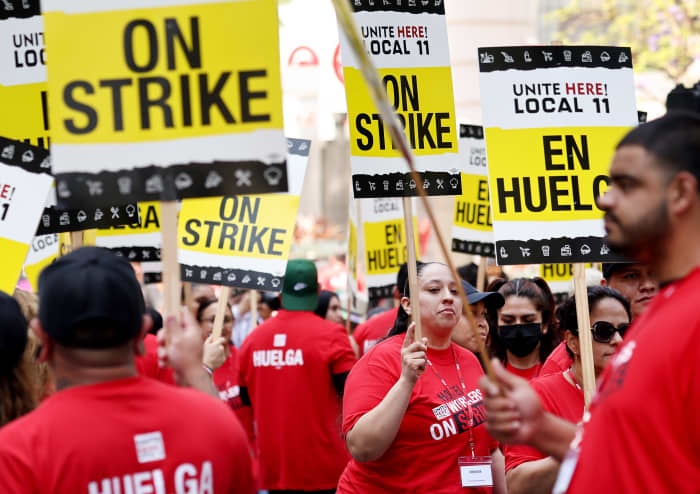

3. Labor unions’ heightened power: Labor unions have grown more powerful as they’ve become more successful in organizing new workers and winning strikes in recent years. The labor unrest is being felt across a wide range of industries, including transportation, healthcare and retail. Some of the most notable strikes in recent months include:

• Thousands of hotel workers in Southern California walked off the job July 3, demanding higher pay and better benefits. The strike involved workers at 19 hotels in Los Angeles, Orange, and San Diego counties. The workers are members of the Unite Here union.

• 20,000 nurses at Kaiser Permanente hospitals in California went on strike July 11, demanding better staffing levels and safer working conditions. The strike involved nurses at 10 hospitals in the Los Angeles area. The nurses are members of the National Nurses United union.

• Thousands of Hollywood writers went on strike May 10, demanding better pay and benefits. The strike involved writers for television, film, and streaming services. The writers are members of the Writers Guild of America, West.

More strikes could be coming soon. Important negotiations now ongoing could lead to significant strikes, including:

• The United Auto Workers (UAW) has three separate contracts with General Motors

GM,

These are just a few examples of recent labor unrest. Many other strikes are going on across the country, and we likely will see more in the coming months and years.

Read: AI gives big business the power to bust labor unions

The Fed meets the wage-price spiral

Now that almost everyone is bullish on the outlook for the economy and the stock market, a renewed wage-price spiral should be added to our worry list. The risk is the U.S. Federal Reserve concludes that a renewed wage-price spiral is a significant risk that can be avoided only by causing a recession.

Both price- and wage inflation have been moderating so far this year, with the former down more than the latter. As a result, real wages have been rising at a pace consistent with a modest improvement in productivity growth. The risk is that a wave of labor strikes and expensive new contract settlements could cause wage inflation to rebound, forcing companies to raise their prices at a faster clip again. That would trigger a renewed wage-price spiral.

We continue to expect that rebounding labor productivity growth will be consistent with wages’ rising faster than prices. We will be monitoring some of the following wage data:

(1) The quarterly Employment Cost Index (ECI) includes series for union and nonunion compensation. Since the first half of 2021, the latter has been outpacing the former. During the first quarter of 2023, nonunion compensation rose 5% year-over-year, while union compensation rose 3.6%. Union workers feel like they’ve fallen not just below price inflation, but also below nonunion workers.

(2) The ECI compensation inflation rate is highly correlated with the core CPI inflation rate. The Fed focuses on the ECI as one of the important indicators of wage inflation that can spiral up and down with price inflation.

The good news is that labor-market turnover is falling, as evidenced by the drop in the quit rate from a peak of 3% in April of last year to 2.6% this past May. This series tends to lead the ECI wages and salaries inflation rate by nine months.

Don’t get us wrong: We are still 75/25 on the odds of a rolling recovery versus an economy-wide recession. But we are spending more time thinking about what could go awry.

Ed Yardeni is president of Yardeni Research Inc., a provider of global investment strategy and asset-allocation analyses and recommendations. This article is excerpted from Yardeni Research’s “Morning Briefing” for July 25, 2023.

Institutional investors may sign up for a free trial to Yardeni’s research service. Follow him on LinkedIn, Twitter and his blog.

Also read: Actors, writers, hotel housekeepers and grad-student workers are all striking for the same reason

More: A potential UPS strike looms. What’s in store for 24 million daily packages?